Contents:

That way you can see the total income for a project, minus the cost of labor and materials. Some companies will even use journal entries to fully job cost overhead and payroll. The Client Data Review can be used to reclassify transactions to add or change classes. If CDR is not available, QuickZoom on any Total row of the Unclassified column for the detail of the transactions that have not been assigned to a class. Click on any of the colored bars, and the list of transactions below will change to include only those that meet that particular criteria. To get back to the default display of all transactions, click the Clear/Show All link in the upper right of the screen.

You then need to specify whether the account is a sub-account of another parent account. Sub-accounts are just there to help keep your accounts organized. For instance, you can make accounts for phone and water a sub-account of a utilities account. If you choose to make this a sub-account, then select the parent account from the dropdown menu. The chart of accounts is a listing of where all the money flows in your company.

- For example, if you are looking for anything related to travel expenses, just type ‘travel’ into the search bar and any related accounts will appear instantly.

- These transactions show up in the Bank Review window as a matched transaction and you press Match to add it to QuickBooks.

- Stessa will sync transactions each time a user logs in and once every night.

- No, it isn’t, as it lacks multiple tiers that you can scale with.

- A pop-up window will give you the option to email the report, print it or save it as a PDF.

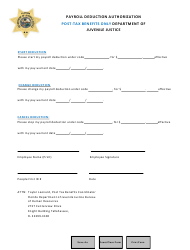

- Above is a graphic showing the Edit Account window.

Alternatively, if you’ve already created a project, you can choose “New project” to add a new project to your account. To perform an action on a batch of selected sales items of the same sales item type, filter the list, as desired. The item could be a “Labor” expense, or it could be a “Material” expense, or “Other” Cost of Goods of Services Sold type expense.

You can also perform an action on a batch of selected sales items of the same sales item type in the Income Tracker in QuickBooks Desktop Pro. For example, you could batch email or batch print selected invoices or mark a batch of estimates as inactive. Then check the checkbox to the left of the list items on which you want to perform the batch action. You can click the checkbox above the column of checkboxes to select all the items shown, if needed. You can also choose how unbilled sales items appear within the list by clicking the “Gear” icon button in the upper-right corner of the Income Tracker window. In the drop-down menu, check or uncheck the checkboxes for the types of unbilled items to show or hide.

How to Record Revenue in QuickBooks?

They are typically things that go into an assembly or installation for which you do not customarily, or cannot track quantities of. The description that you enter in the “Purchase” section will show up on your Purchase Orders, Bills, Checks, Credit Card and Bank Expenses. Remember to turn-on “Show items table on expense and purchase orders” under “Account and Settings”, “Expenses”, “Bills and expenses”. This is what allows you to pick an item from your Product and Service list. If you’re consistently seeing patterns that you don’t like, call us.

Hi, Kerry here from My Cloud Bookkeeping, do you sometimes offer your customers or clients a discount and want to keep track of that separately? There’s a way that you can turn on the discount feature in QuickBooks online and track that discount amount separately. Read our guide on independent contractor taxes for the list of taxes, tax rates, and deductions. We also include the steps on how to file the taxes, the dates of when to pay them, and some tips on how to keep independent contractor taxes organized. You can also drill into the underlying data related to each of the color-coded areas by filtering for a particular customer, type of transaction, status and/or date range. Some e-commerce companies may also be able to use the daily sales method – depending on how they sell their products and track inventory.

TAX PRO PLUS

This won’t delete the account information and transactions, so you can keep a record of it. The first thing you need to do is choose the Account Type. Using the information in the Detail Type, come up with a descriptive name for the account. We’ll now take a look at how to add an account in QuickBooks.

Click the Accounting menu item and you will then see a link to the chart of accounts. When running your business, you need a place to go where you can access all your company’s accounts and balances. In QuickBooks Online, this place is called the chart of accounts.

In this article, you learned all about the chart of accounts. You saw that there are several ways to access the chart of accounts. You learned how to reconcile accounts with a bank and also how to quickly find the accounts you are looking for by using the search bar. You can change the settings in the chart of accounts to see your inactive accounts.

The 7 Best Accounting Software for Restaurants in 2023 – Investopedia

The 7 Best Accounting Software for Restaurants in 2023.

Posted: Mon, 19 Sep 2022 23:45:23 GMT [source]

For batch printing, select the name of the type of sales form you selected under the “Print Selected” command in the pop-up menu. To batch email selected transactions, select the “Batch Email” command, instead. To mark selected estimates as inactive, select the “Mark As Inactive” command in the pop-up menu. When you make your selection and click OK, a completed invoice form opens, which you can then check over and save. Accounting software does more than record your accounting information; it helps to make sure that your company stays on a healthy financial level. It has become a trend that any business who decide to stop using the excel spreadsheets opt for the QuickBooks Instead.

Business Line of Credit: Compare the Best Options

You can use the dropdown box at the top of your profit and loss statement to choose to compare your numbers to another period. If you don’t have the accountant’s version of QuickBooks Online, it’s still easy to find your income statement. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. Let us talk about the sources of money earned/income by a QuickBooks user. They can be from bookkeeping, tax work, or payroll services.

QuickBooks Online launches Free Guided Setup to simplify your finances – New York Post

QuickBooks Online launches Free Guided Setup to simplify your finances.

Posted: Thu, 19 Jan 2023 08:00:00 GMT [source]

Click on the arrow next to Manage Transactions in the lower left corner of the screen and select the form you want. The column labels below these lists will change depending on the transaction type that’s active. Cleveland-based accounting firm with a national reach and a focus on saving you time and helping you run your business.

How Stessa makes recording rental income easy

It uses simple language and doesn’t have unnecessary https://bookkeeping-reviews.com/, so it takes very little time to get acquainted with it. It connects with third-party software programs like PayPal and Etsy and other Intuit products such as QuickBooks Online, QuickBooks Payments, and TurboTax. It’s important to note that QuickBooks Self-Employed only offers federal quarterly tax estimates.

Enter a value of ZERO, otherwise QuickBooks Online will create an Opening Balance Equity entry. Within ouraccounting firm, we want to track separately the money earned from tax work, bookkeeping, and payroll services. Therefore we have three separate Products/Services by those names. All three products however point to just one income account called Service Income so there is just one line on the firm’s P&L. If we wanted the P&L to detail the three buckets of income, we could create a separate income account for each product service, but this is not necessary. Either way, no customer names need to be disclosed on the P&L.

Then choose the action to perform from the drop-down menu of choices available. The choices will vary, depending on the type of sales items selected. When you create an item, it is linked to a “Sales” account to track the “Income” it produces, and a “COGS” account to track how much you spent on the purchase of the product you sold. When customer invoices or sales receipts are created, the related Income and Expense entries are automatically created in your QuickBooks Online account. If you forget to assign a class to a transaction, QuickBooks will remind you by listing the income or expense in an ” unclassified” column. Double click on the entry to recall the unclassified item.

He brings his expertise to Fit Small accounting focus limited’s accounting content. One note to add, Income tracker is not available when the multicurrency feature is in use. From this window you can even take “batched” actions, such as printing or emailing. With one click , a color-coded ribbon appears at the top of the QuickBooks screen, which displays three statuses — Unbilled, Unpaid and Paid.

- Several advanced setups may have several income accounts, to monitor different revenue types.

- At the top of the chart of accounts, you can select to view the chart or reconcile your books with your bank records.

- So we’ll pop up here to reports, and will go to our profit and loss, and you can see here, we have design income.

- This might be the reason why the amount shows negative.

Click the down arrow in the Action column to take care of tasks related to that transaction. Click the Income Tracker link in the toolbar to open the tool’s main screen. If you’ve been using QuickBooks for a while, you’ll see a framework like this with your own company’s data already filled in. Connecting with your Stessa account 24/7 and sharing access with business partners and co-investors. Creating an unlimited number of portfolios and properties – single-family rentals, residential multifamily properties, and short-term and vacation rentals. Stessa software is specifically written for real estate investors, is much more intuitive to use, and is free.